Originally published by Fuse. Director of Effectiveness, Tom Goodchild, analyses sponsorship of the UEFA Champions League to show how it creates long-term value for brands.

Until recently, the past few months have seen a complete sporting shutdown, which means the loss or postponement of marquee moment for which there is no substitute.

While many have questioned the value of sponsorship during the lockdown, we have analysed sponsorship of the UEFA Champions League (UCL) to show how it creates long-term value for brands to help ride out periodic storms such as Covid-19. Key findings from analysis of 6 UCL sponsors in the UK, coupled with additional European insight, can be summarised as follows:

- Sponsorship effectiveness grows over time. Any ‘shocks’ are short-lived and don’t really influence long-term impact (albeit some short-term outputs like media value may be impacted)

- For brands that commit long-term, we have found that sponsorship across multiple sports, both global and local, pay back commercially at an average of £3.40 for every £1 invested in sponsorships

- Sponsorship can impact master brand awareness but there is a cap in some markets due to the sponsors already being household names

- Sponsorship has a long-term impact on master brand consideration by significantly increasing consideration with UCL fans in the UK showing a 29% relative increase when compared to non-football fans

- There is evidence to suggest that, on average, this is driving an additional 2.2% of a brand’s overall consideration which, in turn, impacts sales

- Where historical sponsors have exited, the brand metrics built amongst UCL fans do not fall away immediately and are significantly higher amongst fans years after (and will be prolonged by the current situation)

- Brands who maintain or increase their investment during times of uncertainty are likely to reap long-term market share benefits

Introduction

Until recently, the past few months have seen a complete sporting shutdown. At a commercial level, this has led to revenue shortfalls across a number of industries coupled with reduced inventory for many broadcasters and sponsors.

When it comes to sponsorship, there is no substitute for marquee moments. Unlike spend on traditional media channels (which can be turned off, paused or redeployed), sponsorship wholeheartedly relies on the live match experience which can’t be as easily ‘reallocated’.

While many have questioned the value of sponsorship during the lockdown, this paper emphasises the long-term effectiveness of sponsorship. Specifically, we have analysed sponsorship of the UEFA Champions League (UCL) to show how it can create long-term value for brands and help ride out periodic storms such as Covid-19. In fact, we’ve discovered that these periodic interruptions don’t make much difference to long-term ROI.

The benefits of long-term investment

Marketing budgets often get cut in times of uncertainty. Sponsorship is no exception.

However, evidence suggest that brands can capitalise on the likelihood that their competitor set will freeze and cut investment. Those that do can increase overall share of voice which, in turn, helps drive overall share of market.

- A WARC analysis from the previous recession found that brands who decreased their investment in communications saw their share of market (SOM) decline by 0.2 points. Those that maintained or increased spend, saw their SOM increase by 0.5 points

- Millward Brown analysis from previous recessions showed that brands who went “off-air” for a year or halved their investments took 3-5 years to recover to pre-recession levels

In particular, those that invest in brand building initiatives, such as sponsorship acquisition and/or execution, can help deliver long-term business impact.

Proving the impact of the UCL in the UK

By looking at available YouGov brand data across multiple sponsors and audiences, we have been able to approximate the wider brand uplift of UCL sponsorship on the key metrics of its major partners. This is not quite the same as analysing brand side data. However, the same approach and methodology would apply and, in the cases where we have compared both sets, the proportion of brand driven remains relatively stable. Unless the brand side data shows extreme variations, we wouldn’t expect findings to change significantly relative to what features in this paper. While the relative changes between YouGov and client specific data remain relatively stable, there can exist significant differences between sponsors and different sports.

Overall, this approach has enabled us to estimate the longer-term ROI of their respective UCL sponsorships.

Driving brand metrics amongst fans & a focus on consideration versus awareness

The analysis shows that awareness continues to increase amongst UCL fans. This is more telling given that the majority of UCL sponsors are already household names and, as such, we would normally expect the impact to limited.

Of the brands analysed, we identified a 3.2% uplift in awareness amongst fans when compared to the national sample, a relative increase of 3.5%. When expanding this to look at Europe’s top 5 markets, uplifts remain stable with master brand awareness uplifts of sponsors averaging between 2-3% across the remaining markets.

While this is a positive story, it’s unrealistic to expect the partnership to push the dial much further in these areas. As such, sponsors should switch their attention to pushing lower-funnel behaviours.

Once we start to look further down the funnel at metrics such as consideration, we start to see far more significant shifts. We discovered that UCL fans display a 5% increase when compared to national sample. On average, this 5% increase represents a 29% relative uplift amongst UCL fans, presumably from those fans who are aware of the brand sponsoring the tournament.

This suggests that the sponsorship is as effective (if not more) at driving lower funnel metrics than other channels.

Isolating the wider impact

Not everyone is a UCL fan and sponsors often choose to sponsor a property that over-indexes with their audience to increase exposure cost effectively.

Using Fuse’s brand linkage methodology across this group of sponsors, we’ve been able to remove this inherent bias. This has enabled us to approximate what proportion of the brand uplift is incremental to the audience and how this is driving the wider brand.

On average, we found that UCL is driving an average 2.2% of overall consideration across the sponsors. While this may sound small on the surface, it’s important to consider the scale of these companies coupled with the reach of the property. All of a sudden, it’s easy to see how effectively the sponsorship pays back, especially because these companies know how uplifts in consideration contribute to sales and overall revenue.

From our own deeper analysis across multiple clients involved in sport, we have discovered that sport sponsorships pay back at an average long-term ROI of £3.4 for every £1 invested. While this varies by sport and industry, our benchmarks enable us to better quantify success and predict the impact for current and prospective partners.

In combination with traditional media ROI approaches we are now able to show the value for money the sponsorship provides as well as the potential business return, this is proving to be a very effective story for our clients.

Brand uplift is a slow build

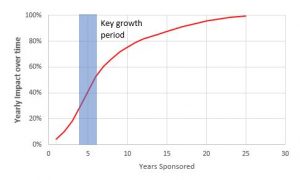

Like brand advertising, sponsorship takes time to build. It often takes a few years before the benefits peak. While there is an immediate uplift of sponsoring the UCL, we found a significant correlation between the number of years a brand has been a partner and the relative consideration uplift. Interestingly, this relationship is not necessarily linear. While benefits do grow for the first few years, it is between years 4-6 (1-2 sponsorship cycles) where most incremental consideration occurs.

Furthermore, we discovered that the impact of sponsorship is only at 75% of its full impact after 10 years (3-4 cycles). It’s key to note that in this case the impact is cumulative, the longer the brand sponsors the tournament the larger the impact the business will receive each year it is a sponsor, suggesting the sponsorship gets more cost-efficient each year. Those sponsors who have therefore been the longest serving will likely have higher long-term impact being driven by the sponsorship each year.

Given how long this impact takes to build, short-term disruption caused by events such as Covid-19 will, in fact, have a relatively small impact on existing sponsors.

Interestingly, previous sponsors’ metrics amongst UCL fans are still high when compared to non-football fans, non-UCL fans and general football audiences. In fact, uplifts amongst fans are still at 60% of the current sponsor average for sponsors that exited 4 years ago. Given the current hiatus in play, we anticipate the speed of the drop-off to decrease (especially as other tournaments and sponsors also aren’t receiving any TV airtime).

While we understand the challenges that come with disruption, evidence suggests that sponsorship is a long-game. Specifically, its impact on master brand consideration (and, by extension, sales) is significant and, perhaps, under-appreciated until now. Overall, this adds to the argument that brands should continue to use sponsorship as a core brand building device which is critical to long-term growth.

A reminder of the key points from our analysis

- While UCL is an awareness driver amongst fans, there is a natural ceiling due to how well known these brands already are

- UCL has a significant impact on lower-funnel metrics. In the UK, fans have 29% higher consideration of UCL sponsors when compared to a national sample/the rest of the population that aren’t football fans

- There is evidence to suggest that, on average, this is driving an additional 2.2% of a brand’s overall consideration which, in turn, impacts sales

- Duration of the sponsorship is key to driving this uplift and the majority of gains are not seen until 4-6 years into the sponsorship, even after this sponsorship continues to get more cost efficient

- Short-term interruptions may impact outputs such as media value, but do not influence long-term effectiveness

- UCL has a halo effect on former sponsors too. Despite no longer being present, metrics do not fall away immediately, and the decline looks to be gradual

Fuse is powered by Omnicom Media Group, specializing in partnerships and experiences in sport, entertainment, cause and culture.