This article was originally published on Control Publicidad and has been translated into English.

Last year, OMD Worldwide introduced the “Fast Start Dashboard”, a data platform which allows the agency to detect trends and make decisions with agility.

The fact that the travel sector has been greatly affected in the last two years is not new to anyone, especially for airlines, which have experienced a 72% drop in the number of travellers since 2019.

Certain signs of recovery are already being detected. In 2025, it is expected to reach 10 billion euros in sales, 9% above the current value. By that date, tourism will return to pre-pandemic levels and it is estimated that there will be 32.5 million trips outside of Spain and an expenditure of 27.5 million euros. Yet there is a long way to go and it is uncertain.

The Fast Start Dashboard combines multiple data sources and provides us with a different look at buying habits, decision-making, digital behaviour, media trends and macroeconomic environment, with the aim of detecting emerging brands and opportunities.

Spaniards regain confidence

In recent weeks, consumers have begun to feel more confident with the escalation of vaccinations. Since May 2020, we have achieved a confidence index of 90 versus 52 last year, and the levels are approaching those of 2019, with only 12 difference.

Interest in traveling becomes Top of Mind

The most recent data from the Fast Start Dashboard revealed that consumers are prepared and eager to travel. Travel searches have grown 100% in Spain at the beginning of June compared to the previous year and, most importantly, 1 in 3 of Spaniards say they are “feeling safe traveling by plane” and more than half “are in the process of booking to stay in hotels”. These are indicators of the high predisposition of the traveller and the need to be present in their searches. We need to be top of mind and make our brands the provider of choice for their vacations.

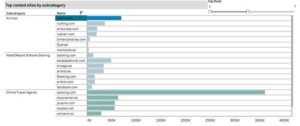

With this platform we can also know the granularity of the data, which allows us to make tactical decisions. In the last month, visits to the social sites of the main airlines have tripled. Iberia, for example, tops the list with 695,000 visits to its website and its level of social interactions on Twitter has increased by about 88% to 9,000. Among online travel agents, Booking.com ranks as the most visited. This information strategically helps us to focus on the most relevant moments, platforms and content, and in real time.

Habits have changed. People travel locally, seek flexibility and are more vigilant about spending.

In a sector with long purchasing process, we have seen a change in habits. As travellers, we plan more in the short term, but we also prioritise national and closer destinations.

Today, 25% of consumers are planning national trips. Among the vacation destination preferences of Spaniards in 2021, there is great interest in warm destinations; Andalusia, the Balearic Islands and Valencia, are positioned as the most sought after.

The current trend is to seek greater safety in the trip, flexibility of cancellations and advanced technology that helps us take controlled risks. The expectation of spending has decreased and the youngest are organising to pay a quarter less this year. The most carefree are those between 35 and 54 years old, who cut this figure in half. This gives us more data to communicate in segments with a relevant message for each. The key is to consider what the consumer wants in the here and now.

Spain was one of the leading countries with the most tourists per year pre-2020, and today’s use of market intelligence in Spain has never been so prevalent and essential to help brands make decisions with a positive impact on their business results.

Never before has the need for accurate and relevant data been so emphasised, allowing us to immediately examine the business and marketing ecosystem to make better decisions, faster.