Article first published in Adweek.

Tracking consumer attention for optimal media placement

Omnicom Media Group’s largest agency, OMD, found a way to measure attention and harness those metrics, which it now uses in client planning. The Attention Requirement Calculator (ARC) was built with Omnicom’s data strategy arm Annalect. The company tells Adweek the tool automates attention-informed planning to make clients’ media spend more efficient and effective.

“Attention impacts every stage of the design process, and it closes the chasm between strategic planning and strategic investment,” said Chrissie Hanson, global chief strategy officer at OMD.

Here’s how it works

The tool determines how advertisers must engage consumers if they want to achieve a desired outcome. It tells planners which content formats on which platforms will be most effective for a particular brand or product.

If the tool recommends the ad should engage consumers for 3 seconds, “then you need to consider what channel and platform will provide that amount of mental availability to the audience,” said Philip Lincoln, managing director of communications planning at OMD.

In tests conducted last year, attention-informed planning made clients’ total media spend between 3% and 11% more effective by identifying potentially wasteful investments and reallocating that spending elsewhere. It showed one CPG portfolio brand could save $200,000 in just two weeks, based on the projected spend for that period compared to the projected spend when accounting for attention-based recommendations. OMD estimates it could save that brand $2.5 million annually.

“You probably don’t need the same amount of attention to sell Clorox wipes than you would to sell a testing kit from Ancestry,” said Sebastien Hernoux, managing director for data and technology at OMD who steered Annalect’s product development process.

Harnessing attention

Annalect used its technical expertise to build the ARC and integrate it with Omni, the operating system OMG uses to plan and activate. Data from Australia-based Amplified Intelligence (AI) underpins the calculator. AI runs research on behalf of OMD and more than 25 clients, including McDonald’s and Renault. It partners with Twitter, Yahoo, Snap, Teads and more to run tests, which OMD funds, across the U.S., Canada, the U.K., France and Mexico.

OMD ingested test data and, with Annalect, built a predictive algorithm that reveals the amount of attention required to drive results.

Clients participate in a two-month test spanning three to five countries at a time. The testing process gleans the insights OMD needs to sharpen future planning, activation and investment decisions. The tool also generates reusable insights, since the testing process helps OMD gauge if variables like product, creative themes and ad length impact attention. It uses test data to gather insights about categories that it can apply to brands that do not partake in testing.

“We’re interested to understand what’s the requirement if it’s travel vs. auto vs. CPG,” said Hanson.

The tool within Omni

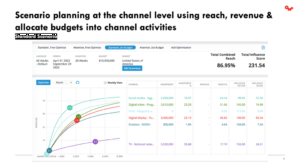

Images of the Omni interface shared with Adweek demonstrate the concept and reflect a hypothetical media plan built for a consumer specialty product. One example shows the recommendations of Omni’s Channel Planner before integrating the ARC’s recommendations.

Another example shows how the application shifts its recommendations when accounting for ARC inputs.

In the first scenario, which did not use the ARC the tool to factor in attention metrics, more money was allocated to TV. But after applying the ARC tool, the plan recommended investing “quite a bit in TV, but now it’s reallocated to audio, which did not pop in the original scenario, but did in the attention scenario,” said Tara Amalfitano, director of communications and strategic planning at OMD.

How to measure attention

AI gleaned its insights by developing an app called AttentionTrace, which films users (with their permission) by tapping into the cameras on their smartphones, tablets or TVs as they experience organic ads. The company has access to about 150 million people around the world through its panel-based technology partner.

“We get triple opt-in for someone to download our app and on their phone next time they’re on Twitter, YouTube, TikTok, Yahoo—whatever it is that we we get permission to gain—the camera’s turned on,” said Hanson.

The app data found that consumers have three attention levels: actively engaged; passively engaged (users looking at their screens but not at ads); and inattentive (users who are looking away from their screens).

AI’s data supports what media planners intuitively know but is hard to reliably prove: viewability and time-on-screen are flawed metrics, and attention metrics are a valuable barometer when harnessed by agencies.

“Understanding what a human is doing on different platforms and in different formats and in different environments is what is key to understanding whether a brand grows or not, that’s as simple as it is,” said Karen Nelson-Field, founder of Amplified Intelligence.

Cross-agency collaboration

The tool can help inform creative strategy, too. OMD collaborates with Omnicom creative agency BBDO on the accounts both agencies share to make sure that creative work makes sense for an attention-informed media plan.

“If you understand that granularity at the brand and the category level, we can really sharpen and know what’s realistic, what’s not,” said Hanson, adding that it’s “a really great way of bringing us and the Omnicom creative agencies together because they’ve always understood the language of attention.”